Experience the benefits of selecting us for your demat account - enjoy a Free Demat/Trading account, Zero AMC, and no hidden charges! Exclusive Research Support, and secure transactions with our trusted platform.

Open a Free Demat Account Online

No Fees, Open your demat and trading account for free and start investing your money smartly.- Zero A/c Opening Charges

- Zero A/c Maintenance Charges

Fast and Secure Onboarding - Open Demat Account Now !

Verify your Mobile Number

& Email id

Verify Bank and KYC Details

Upload your Documents using DigiLocker

Sign the Documents with an eSign

Why Open Demat Account with Integrated

A Legacy of Trust

Trust built over 50 years of securing your investments

Join the Crowd

Over 1M happy Demat account holders already trust us

Effortless and Paperless

Quick and straightforward account opening in minutes

Budget-Friendly

Competitive costs that ensure value for your money

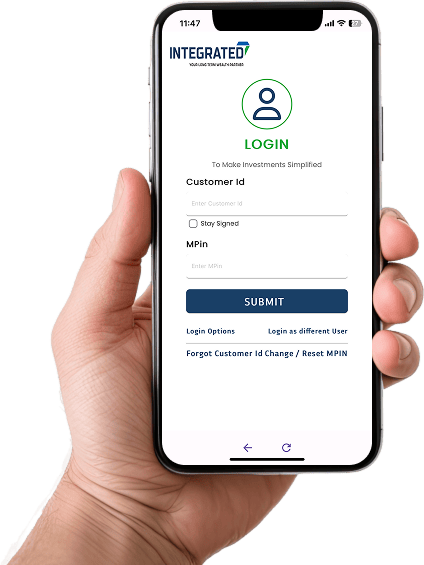

User-Friendly Process

Navigate our user-friendly app and web portal with ease

Consistent Winner NSDL Awards

Access our acclaimed research and advisory services to stay well-informed

One Demat Account, Endless Investment Possibilities

Streamline your investments with a single Demat account, giving you effortless access to an extensive range of options through our integrated platform.

Equity/Stocks & IPO

Send money between accounts in seconds with real-time processing, ensuring your transactions are fast and secure.

Equity SIP

Never miss a payment with automated reminders for bills, utilities, and subscriptions directly in your dashboard.

Margin trading Facility (MTF)

Calculate potential loan options and repayment schedules with ease, helping you plan for major financial decisions.

Future & Options

Track expenses automatically, set spending limits, and receive personalized insights to improve your financial health.

Mutual Funds

Access easy-to-use tools to manage stocks, bonds, and mutual funds with real-time market updates and insights.

Gold ETFs

Convert between multiple currencies instantly, providing up-to-date exchange rates for seamless international transactions.

Take the First Smart Step Toward Smart Investing!

Know More Information About Demat Account to Invest Smarter

What is a Demat Account

A Demat Account, also known as a "Dematerialized Account," is a crucial element within the Indian stock market. It functions as a digital repository for your shares and securities, removing the necessity for tangible certificates. This account streamlines the procedures involved in purchasing, selling, and transferring shares, guaranteeing a smooth and eco-friendly experience for investors. Through the transformation of physical shares into electronic format, a Demat Account offers heightened security and decreases the vulnerabilities linked to the loss, theft, or destruction of paper certificates. Additionally, it enables quicker transactions, establishing itself as an indispensable instrument for contemporary trading and investment practices.

Why You Should Have a Demat Account?

- Facilitating Digital Activation for Minors: Minors are able to initiate the opening of a Demat Account with the guidance of a guardian. The account remains under the supervision of the guardian until the minor comes of age (turns 18) safeguarding the management of their investments with prudence.

- Diversify Your Investments Across Multiple Segments: By utilizing a Demat account, you gain the freedom to diversify your investment portfolio across a wide range of market segments such as equities, mutual funds, bonds, and beyond. This adaptability guarantees that all your investments are centralized in a single location, delivering a smooth and effective investment journey.

- Effortless Portfolio Administration: With a Demat account, overseeing your investment portfolio becomes effortless as you can monitor and control all your assets within one account. This amalgamation facilitates enhanced supervision of your investments, enabling you to make well-informed financial choices with convenience.

- Streamlined Corporate Benefits and Operations: Utilizing a Demat account streamlines the receipt of corporate benefits like dividends, interest, and bonuses. All corporate actions are promptly updated in your account automatically, guaranteeing that you stay updated on all benefits without any oversight, thereby facilitating a seamless and efficient process.

- With a Demat account, transferring shares is expedited and efficient. Transactions are conducted electronically, leading to significant time savings in settlement processes and enabling you to manage your investments promptly and seamlessly.

- Reduced Risk of Fraud: By utilizing a Demat account, the potential for fraud is significantly reduced. The digital storage of securities eliminates the vulnerabilities associated with physical certificates, ensuring the safety and security of your investments.

Update your Annual Income in Demat & Trading Account

Depositories and Exchanges have made it mandatory to update your annual income in your demat & trading accounts along with other KYC attributes.