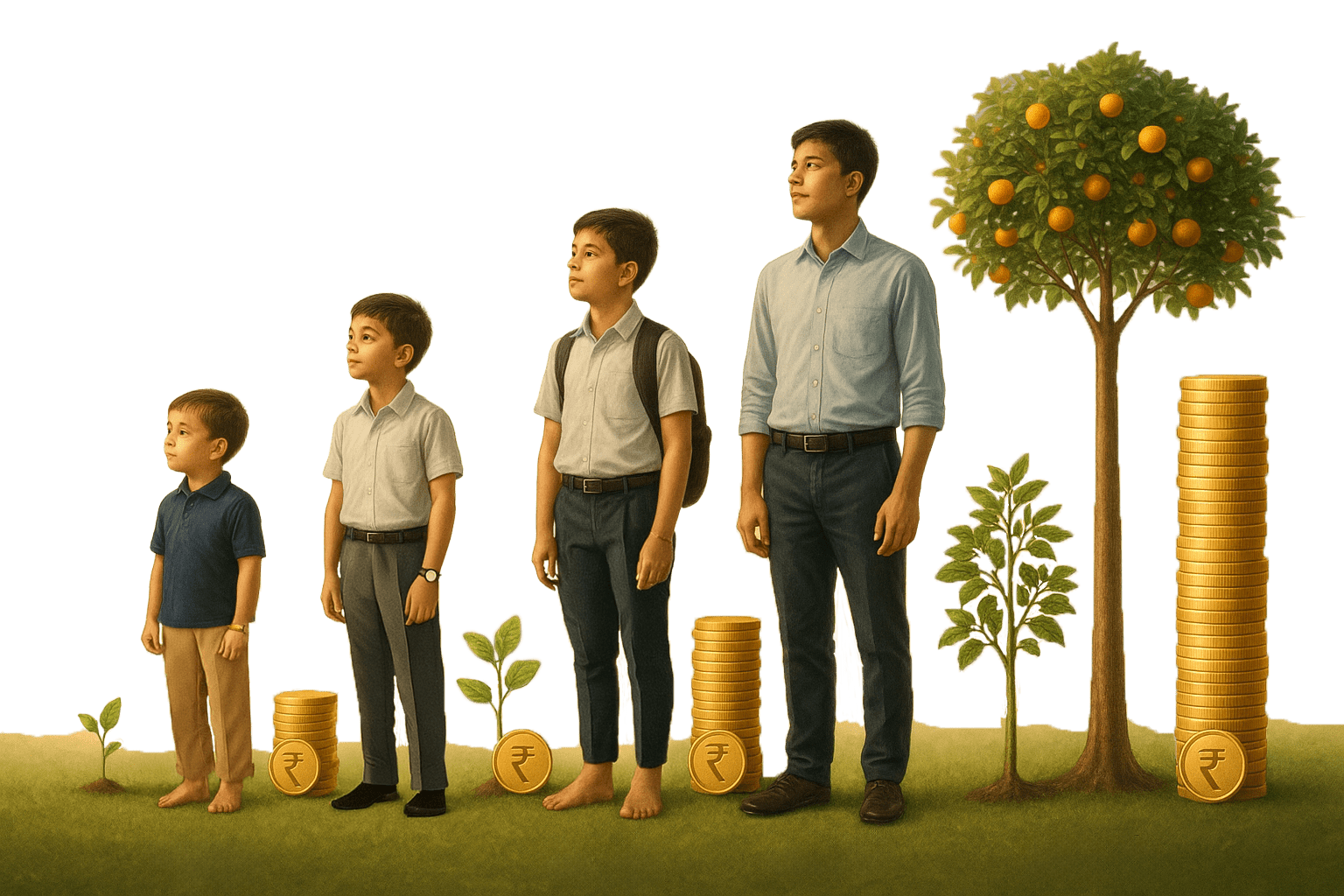

Start Your Champ's Investment Journey Today

Secure and protect

your

childern financially, we provide our specially

designed minor demat accounts.

Important Info for Minor Account Opening

Parent Account Required

Guardian must have a demat & trading account (free to open if not available).

Basic Documents Needed

PAN, Aadhaar, birth certificate, photo & bank details of the minor.

Dedicated Minor Account

Account will be opened in the minor’s name with separate login access.

No Trading Allowed

Intraday & F&O trading not permitted; only long-term investments allowed.

Controlled by Guardian

All actions & bank transactions will be managed by the parent/guardian.

Reasons To Choose Integrated

We make investing for your child's future simple, secure, and rewarding

Secure & Safe

Bank-level security with 256-bit encryption ensures your child's investments are always protected.

Zero Fees

No account opening charges, no maintenance fees, and no hidden costs. Invest more, pay less.

Financial Education

Special learning resources to teach your child about money management and investing basics.

Smart Investing

Curated investment options suitable for minors with long-term growth potential.

Required Documents

Everything you need to open your child's demat account

PAN Details

- Digital copy of minor's PAN

- Digital copy of guardian's PAN

Aadhaar Details

- Minor's Aadhaar number for OTP verification

Date of Birth Proof

- Birth certificate (with English translation if needed)

- School leaving certificate

- Passport

- Mark sheet from higher secondary board

Photograph

- Digital passport-size photograph of minor

Bank Proof

- Cancelled cheque

- Bank statement/passbook

Additional Documents

- Legal guardian letter (if guardian is not parent)

- Guardian's address proof (Passport, Masked Aadhaar, Driver's license, Voter ID)

Ready to Secure Your Champ's Financial Future?

Join thousands of parents who are giving their children the gift of financial literacy and wealth creation.

Frequently Asked Questions

Everything you need to know about minor demat accounts