Open a Minor Demat Account with Ease

With Integrated, protect your child's financial future.

Please keep the following documents ready

- For

Minor

:

1. PAN Card & Aadhar Card

2. Passport Size Photo

3. Bank A/c Details

4. Birth Certificate (or) Passport (or) School Leaving Certificate -

For Guardian :

PAN Card, Aadhar Card & Photo

- Relationship Proof (if not Parent)

- Please ensure Minor Pan Card & Aadhar linking is completed.

Get Free Minor Demat Account Today

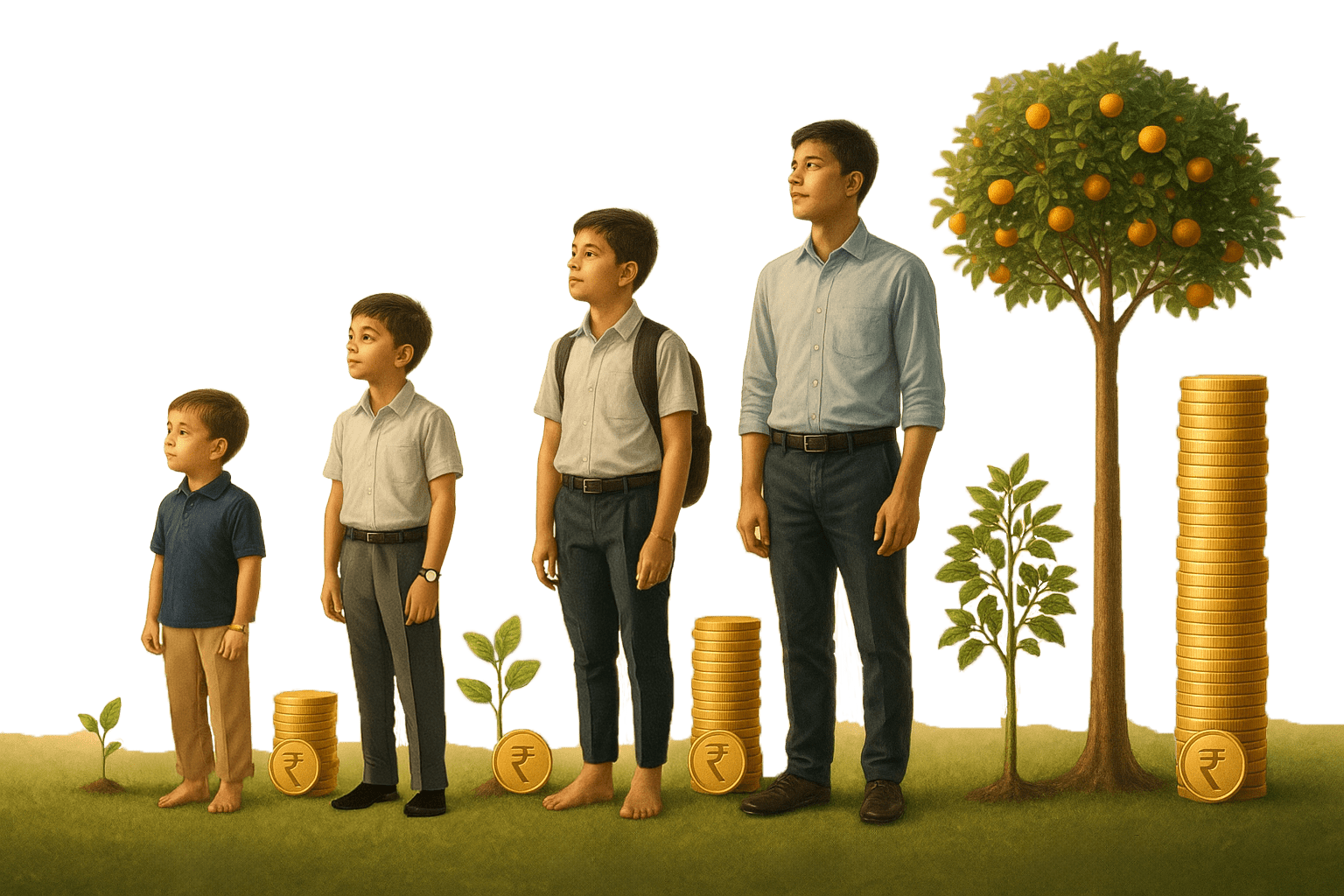

Small Steps Towards Early Investing for Minors

If you are interested in building long term wealth for your child, a Minor Demat Account provides a way to invest at an early age in stocks, mutual funds, and SIPs under the supervision of their guardians. It is an essential first step to smart financial planning and long term wealth creation for your child.

Whether you're planning for your child's education, marriage or future independence, starting early with the best demat account for minors is a wise decision.

Why Open a Minor Demat Account with Integrated?

Integrated offers you the best broker for demat account solutions, tailored to your family’s financial goals.

Minor Demat Account Online

Easily start your Minor Demat Account with our website or app.

Safe & Guardian Controlled

All transactions are under the control of a guardian until the child turns 18.

Sip for your Child

Create a Systematic Investment Plan (SIP) for building wealth through mutual funds and investment learning.

Different Investment Options

Invest in equity, mutual funds, ETF etc to get different asset classes, companies and sectors to get more diversification.

Trusted Investment Partner

We have decades of experience in wealth creation for families across India.

Benefits of Investment for Minors in India

We make investing for your child's future simple, secure, and rewarding

Compounding Advantage

The more time you spend in the market the more power of compounding helps you to grow your wealth.

Discipline & Habit

Investing in your child's name will help you become more motivated to prioritize your child's financial goals.

Tracking the Investment

You can track all the investment through our website or app which is easy to understand.

Goal Based Investing

When you invest in a minor's name, you are allocating a portion of your other investments to a particular goal, like paying for a child's education or marriage.

Open a Minor Demat Account for your Child’s Financial Freedom

Join us and give your little one the gift of early financial growth

Get Free Minor Demat Account Today

Frequently Asked Questions

Everything you need to know about minor demat accounts