What are Life Cycle Funds and How Do They Work?

Mutual Funds

Mutual Funds in India

SEBI Update

Read More

Different Investment Styles Every Investor Should Know

Stock Market

Investment styles

Investment planning

Read More

What is the Difference Between CAGR and XIRR?

Mutual Funds

Mutual Fund Investment

Financial Metrics

Read More

What is CAGR? A Simple Guide for Investors

Mutual Funds

Mutual Fund Investment

Financial Metrics

Read More

What is XIRR? A Simple Guide for Investors

Mutual Funds

Mutual Fund Investment

Financial Metrics

Read More

5 Things You Should Do Before Investing Money

Financial Planning

Investing Basics

Personal Finance

Read More

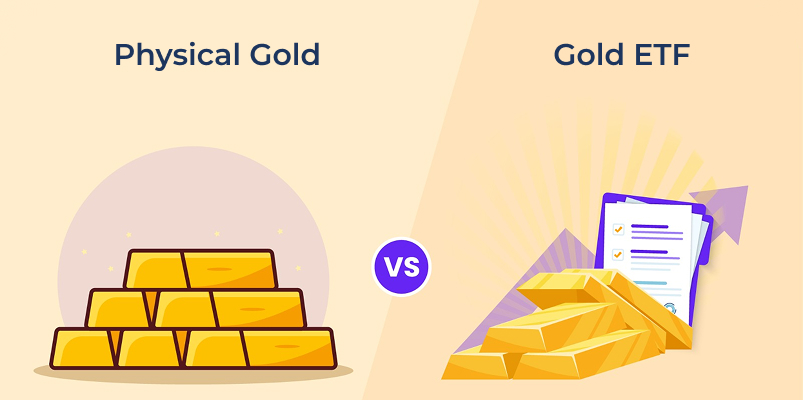

Difference Between Gold ETF and Physical Gold Explained Simply

Gold ETF

Gold Investing

Commodity Investing

Read More

What is STRI and How It Empowers Women to Take Charge of Their Finances

STRI

Women Finance

Financial Empowerment

Read More

How to Choose the Best Mutual Fund for Your Financial Goals

Stock Market

Investing Mindset

Investor Psychology

Read More

How Market Fluctuations Can Become Your Best Friend in Investing

Stock Market

Investing Mindset

Investor Psychology

Read More

Union Budget 2026-27: What the New TDS Compliance Change Means for NRI Property Sellers

Union Budget 2026

NRI Property Sale

TDS on NRI Property

NRI Taxation India

Read More

Union Budget 2026-27: Big Compliance Relief for Buyers Purchasing Property from Non-Residents

Union Budget 2026

Budget 2026 Highlights

TDS on Property Purchase

Read More

Budget 2026 Explained: What Costs Less and What Costs More

Union Budget 2026

Union Budget in India

Indian Economy

Read More

What is STT? A Clear Guide to Securities Transaction Tax in India

Securities Transaction Tax

STT in India

Stock Market Tax

Read More

Union Budget 2026 of India: What Actually Changed and Why It Matters

Budget 2026

Tax Updates

Stock Market News

Read More

Stock Market Holidays 2026: NSE and BSE Trading Calendar

Stock Market

NSE Holidays 2026

BSE Holidays 2026

Read More

India's Mutual Fund Revolution: Why SIPs Are Winning

Mutual Funds

SIP Investment

Financial Planning

Read More

Major NPS Changes in December 2025: What It Means for Your Retirement

NPS

Retirement Planning

Tax Planning

Read More

Rupee at 90: What Indian Investors Need to Know

Currency Market

Indian Economy

Stock Market News

Read More

SEBI Updates Mutual Fund Fee Structure to Benefit Investors

Mutual Funds

SEBI Update

Stock Market News

Read

More

Understanding Price-to-Book Ratio: A Valuation Tool for Equity Investors

Equity

Valuation

Stock Market

Fundamental Analysis

Read More

A Smart Way to Start Investing: Open Your Demat and Trading Account

Demat Account

Trading

Investing

Read More

Active Fund vs Passive Fund: Which Fund to Invest In?

Mutual Funds

Fund Comparison

Portfolio Strategy

Read More

Not to Invest Could Be Risky

Invest in the Stock Market

Financial Planning

Long-Term Growth

Read More